Health

THIRTEEN new Ozempic-like drugs are coming in the next few years as part of weight-loss goldrush

Knicks vs. 76ers: NBA report says refs made multiple mistakes against Philly in loss that led to grievance

Sports

Getty Images The Philadelphia 76ers looked like they had Game 2 of their first-round series against the New York Knicks wrapped up …

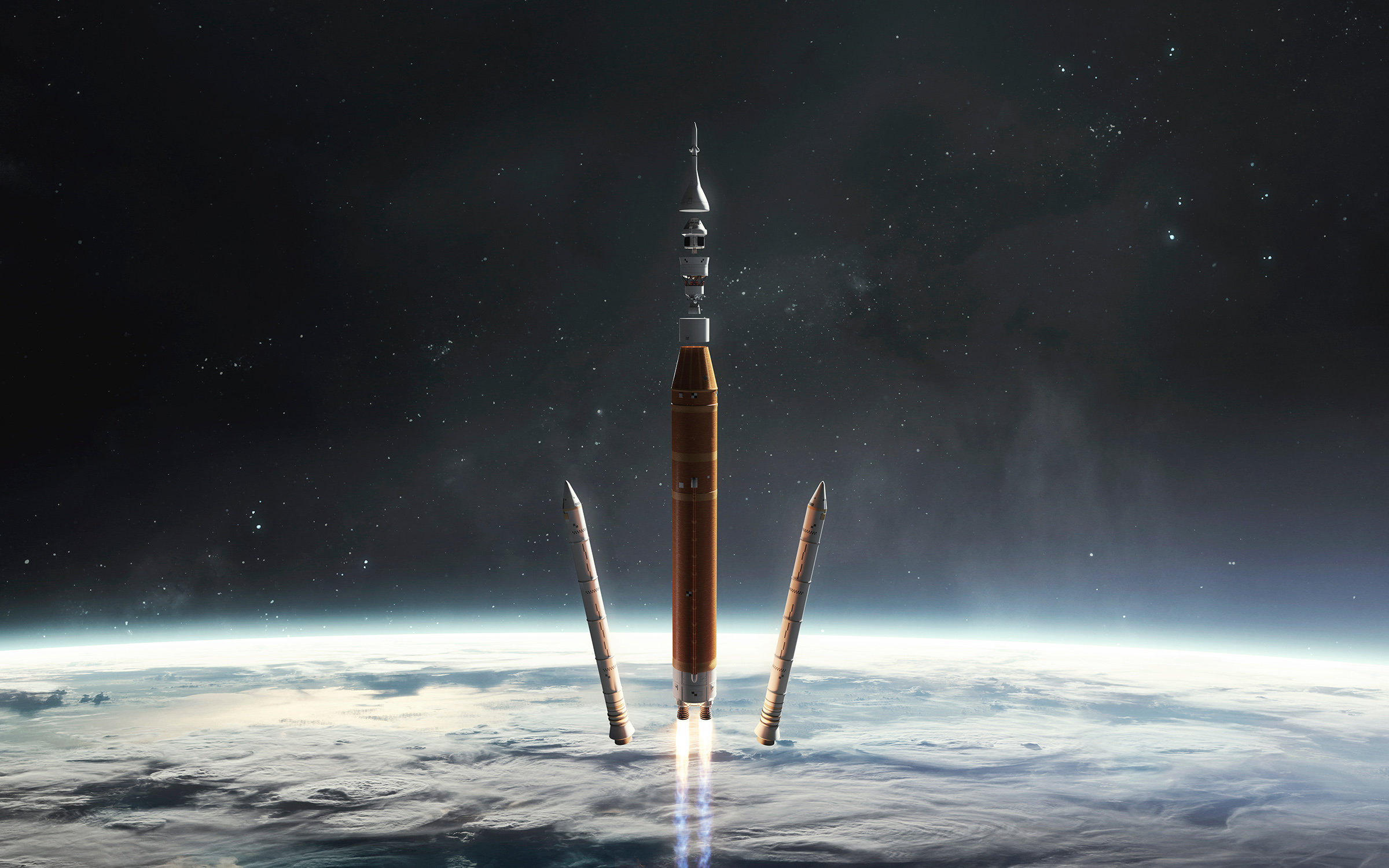

Propellant-free thrusters: Company claims major breakthrough

Science

One of the most expensive parts of any rocket launch is getting the rocket off the ground and into space. This part …

World’s chocolate supply threatened by devastating virus

Health

This article has been reviewed according to Science X’s editorial process and policies. Editors have highlighted the following attributes while ensuring the content’s …

Mail-in ballot results put Summer Lee in strong position over challenger Patel

U.S.

U.S. Rep. Summer Lee, D-Swissvale, the Pittsburgh area’s progressive congresswoman, is in good shape for her reelection bid after a strong showing …

Megan Thee Stallion Accused Of Backseat Sex, Forcing Staffer To Watch

Entertainment

Getty Megan Thee Stallion’s former personal cameraman is taking the Mean Girls actress and Roc Nation to court for creating an “intolerable” …

Athens turns orange, Helsinki goes white as Europe’s weather springs a surprise

World

Costas Baltas/Anadolu Agency/Getty Images Dust from the Saharan desert covers Athens in an orange haze ion April 23, 2024. CNN — A …

Dow Jones Futures: Market Rallies, But Big Tests Loom; Tesla Soars On ‘Affordable’ EV, Elon Musk

Business

Dow Jones futures were little changed after hours, while S&P 500 futures and Nasdaq futures rose slightly. Tesla (TSLA) jumped despite bleak …

Jabra’s noise-canceling Elite 5 are on sale for 40 percent off right now

Technology

At this point, it’s safe to say that Jabra makes some of the most reliable earbuds you can buy, especially for the …

/cdn.vox-cdn.com/uploads/chorus_asset/file/25414079/Jabra_Elite_5_Lifestyle_Press_Image.jpg)