Science

Rainbow-like phenomenon may glow on hellish exoplanet WASP-76b

Entertainment

Taylor Swift’s ‘TTPD’ relationship breakdown by track

Skylines 2 Apologizes For Worst-Reviewed DLC Ever

Technology

The makers of Cities: Skylines II have pledged to focus on fixing the base game after fans revolted against a disappointing paid …

Broncos make it clear that they’ll try to trade up for quarterback they “love”

Sports

The Broncos gave up multiple first-round picks to get quarterback Russell Wilson. It didn’t work out. Would they give up multiple first-round …

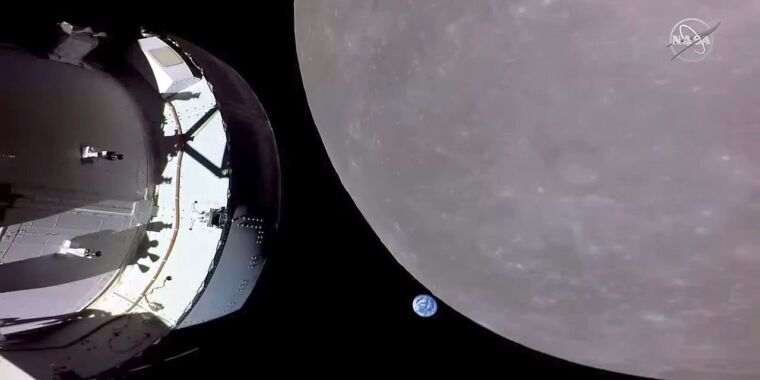

NASA may alter Artemis III to have Starship and Orion dock in low-Earth orbit

Science

Enlarge / This image taken by NASA’s Orion spacecraft shows its view just before the vehicle flew behind the Moon in 2022. …

Infected blood scandal: Children were used as ‘guinea pigs’ in clinical trials

Health

By Chloe Hayward and Hugh Pym Health producer and health editor, BBC News 18 April 2024 Image source, Allan Archive Image caption, …

4/20 grew from humble roots to marijuana’s high holiday

U.S.

SEATTLE (AP) — Saturday marks marijuana culture’s high holiday, 4/20, when college students gather — at 4:20 p.m. — in clouds of …

Prince Harry ‘burnt bridges’ with royal family by renouncing British residency

Entertainment

Celebrities By Nika Shakhnazarova Published April 19, 2024, 9:52 a.m. ET Prince Harry has “burnt his bridges” for good after sensationally renouncing …

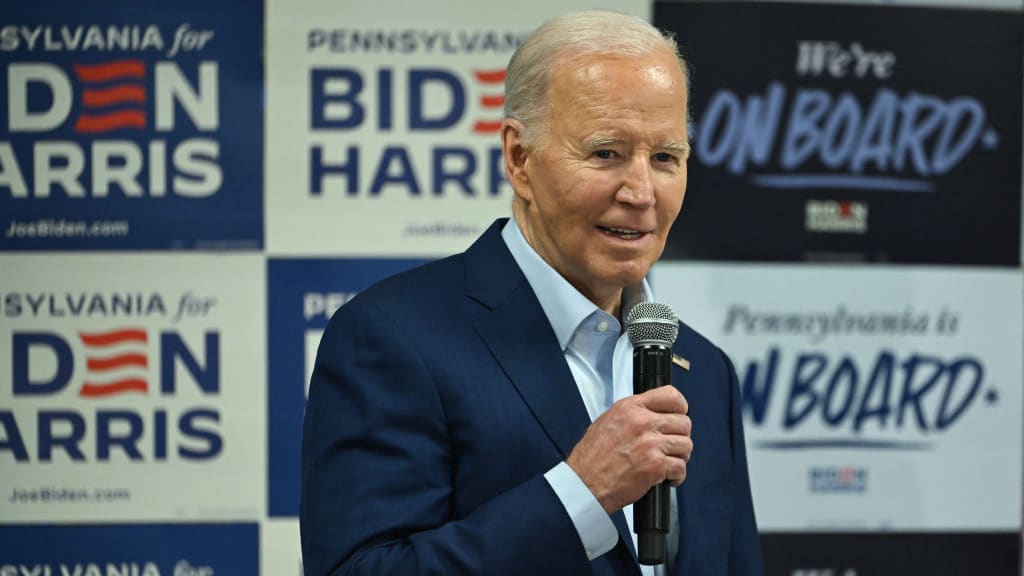

US imposes sanctions on two groups for fundraising for Israeli extremists in West Bank

World

Chip Somodevilla/Getty Images The US Treasury imposed the new sanctions on Friday. CNN — The US Treasury Department on Friday imposed sanctions …

The Verge’s 2024 Mother’s Day gift guide: e-readers, earbuds, mugs, and more

Business

Uno Show ‘Em No Mercy If we’re being honest, you may no longer be your mom’s favorite after you’ve both indulged in …

/cdn.vox-cdn.com/uploads/chorus_asset/file/25385620/247058_Mothers_Day_Gift_Guide_MLouart.jpg)