World

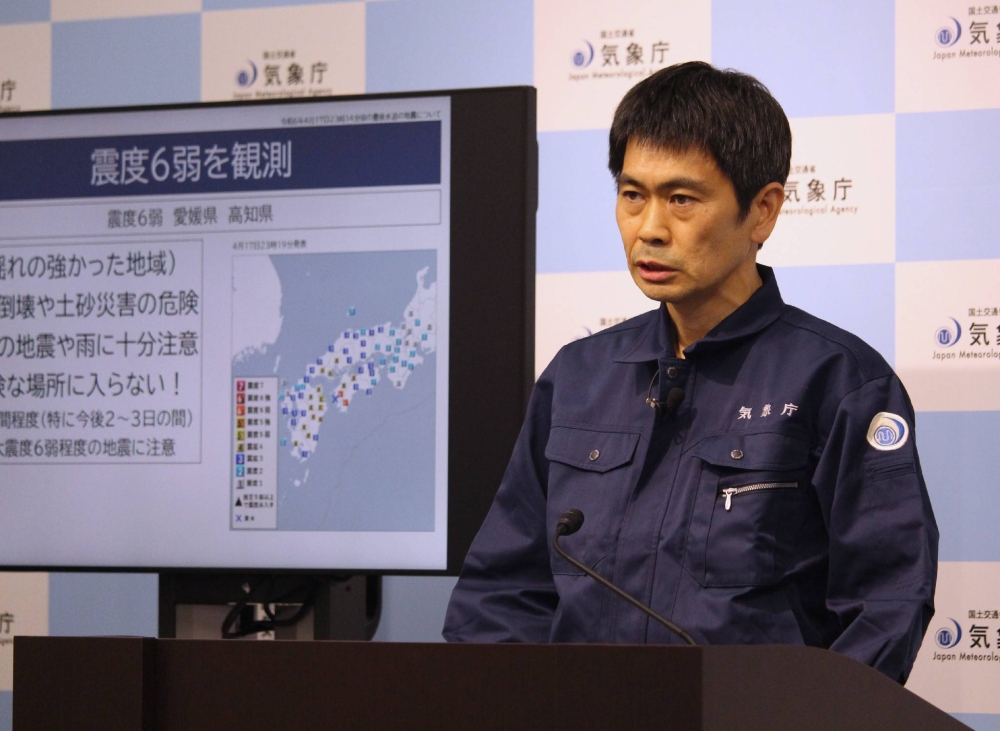

No link to Nankai Trough quake seen after temblor in Shikoku

USC valedictorian Asna Tabassum earned the right to speak

U.S.

In 2022, at the University of Southern California commencement, valedictorian Adam Karelin delivered a stirring poem against Russia’s invasion of Ukraine. In …

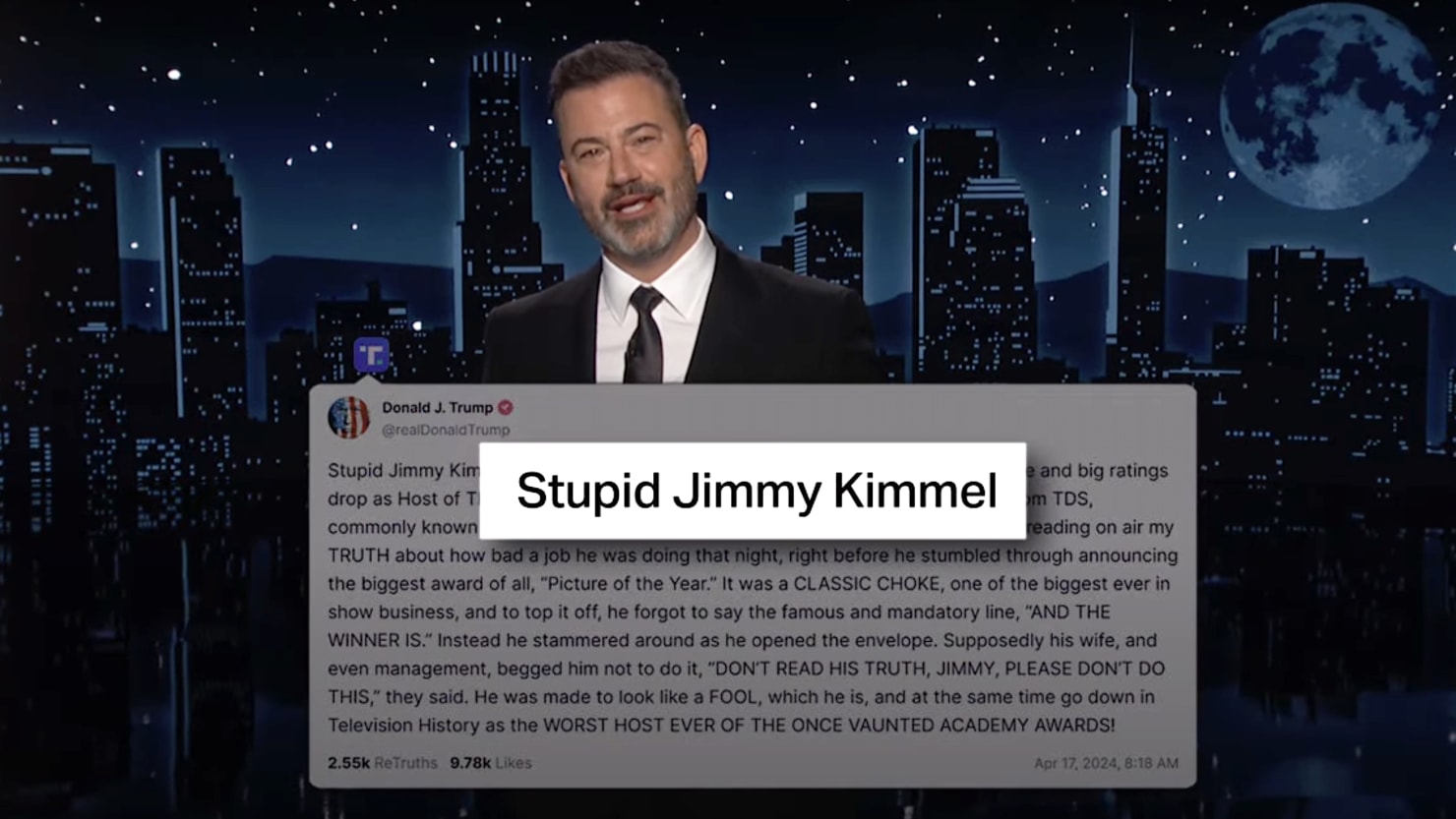

Jimmy Kimmel Lays Into Trump for Confusing Him for Al Pacino

Entertainment

“What a day this was,” Jimmy Kimmel said at the top of his late-night monologue on Wednesday before recounting the “tumultuous morning” …

Trump and Polish President discuss NATO members increasing their defense spending

World

Michael M. Santiago/Getty Images Former President Donald Trump stands with Polish President Andrzej Duda at Trump Tower on April 17, 2024 in …

Google Fires 28 Workers for Protesting Cloud Deal With Israel

Business

Google fired twenty-eight employees Wednesday after they participated in protests against Project Nimbus, a $1.2 billion cloud contract with Israel’s government that …

Update on Weekly Quests — Hearthstone — Blizzard News

Technology

Yesterday, Patch 29.2 went live with some changes to Weekly Quests, making them harder to complete but grant more XP. We had …

Klay Thompson’s exit interview: As free agency nears, what’s next for Warriors legend

Sports

SAN FRANCISCO — Klay Thompson bolted out of Golden 1 Center quickly Tuesday night in Sacramento, the wounds of another elimination loss …

The Great Pyramid’s Latitude Is (Coincidentally) The Same As The Speed Of Light

Science

Spend long enough on the Internet and you will likely be met with a post informing you that the speed of light …

Fish and Game suspects Adenovirus Hemorrhagic Disease as culprit in Upper Snake moose mortalities

Health

The following is a news release from the Idaho Department of Fish and Game. IDAHO FALLS (Idaho Fish and Game) — Idaho …