Technology

AI Detects Mysterious Detail Hidden in Famous Raphael Masterpiece : ScienceAlert

Iran threatens to target Israeli nuke facilities

World

Israel Defense Forces use Iron Dome system to intercept Iran attacks Israel’s Iron Dome defense system helped intercept 300 drones and missiles …

Intuitive Surgical Stock Pops On Quick Uptake For Its New Robotic Surgeon

Business

Intuitive Surgical (ISRG) stock popped late Thursday after the robotic surgery behemoth beat first-quarter expectations as it launched its next-generation system. X …

It took 20 years for Children of the Sun to become an overnight success

Technology

Children of the Sun burst onto the indie scene like a muzzle flash on a dark night. Publisher Devolver Digital dropped the …

Your guide to Bulls-Heat & Kings-Pelicans

Sports

• Download the NBA App The 2024 NBA postseason tips off with the SoFi Play-In Tournament. Get ready for the action with previews and …

SpaceX launches Starlink satellites on company’s 40th mission of 2024

Science

SpaceX launched its 40th mission of the year this evening (April 18). A Falcon 9 rocket carrying 23 of the company’s Starlink …

Hospital prices for the same emergency care vary up to 16X, study finds

Health

Enlarge / Miami Beach, Fire Rescue ambulance at Mt. Sinai Medical Center hospital. ] Since 2021, federal law has required hospitals to …

Takeaways from the day a jury was selected to decide Donald Trump’s fate in the hush money trial

U.S.

New York CNN — Jury selection in Donald Trump’s hush money business fraud case began Thursday looking like the task of finding …

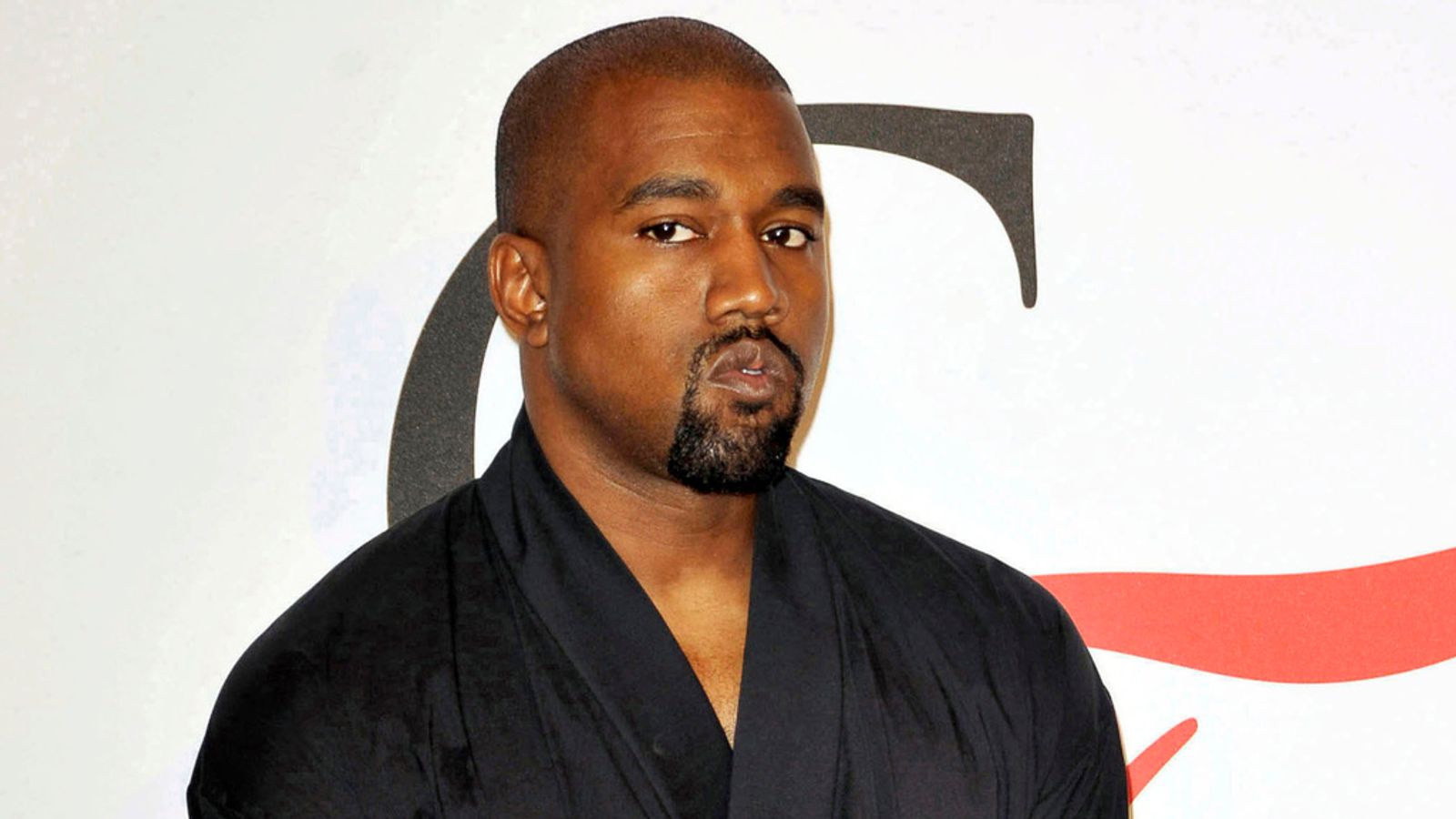

Kanye West: Los Angeles police investigating whether rapper was involved in alleged battery | Ents & Arts News

Entertainment

West’s chief of staff told NBC News in a statement that the incident happened after his wife Bianca Censori was allegedly “physically …