Science

Research reveals a surprising topological reversal in quantum systems

Entertainment

Rebel Moon Part Two: The Scargiver Review

We Finally Know Where Neuralink’s Brain Implant Trial Is Happening

Technology

Elon Musk’s brain-implant company Neuralink has chosen the Barrow Neurological Institute in Phoenix, Arizona, as the initial study site to test its …

Arizona Coyotes relocating to Utah: NHL board of governors approves sale to Jazz owner

Sports

The Arizona Coyotes are officially headed to Salt Lake City starting next season, per league sources, after the NHL’s Board of Governors …

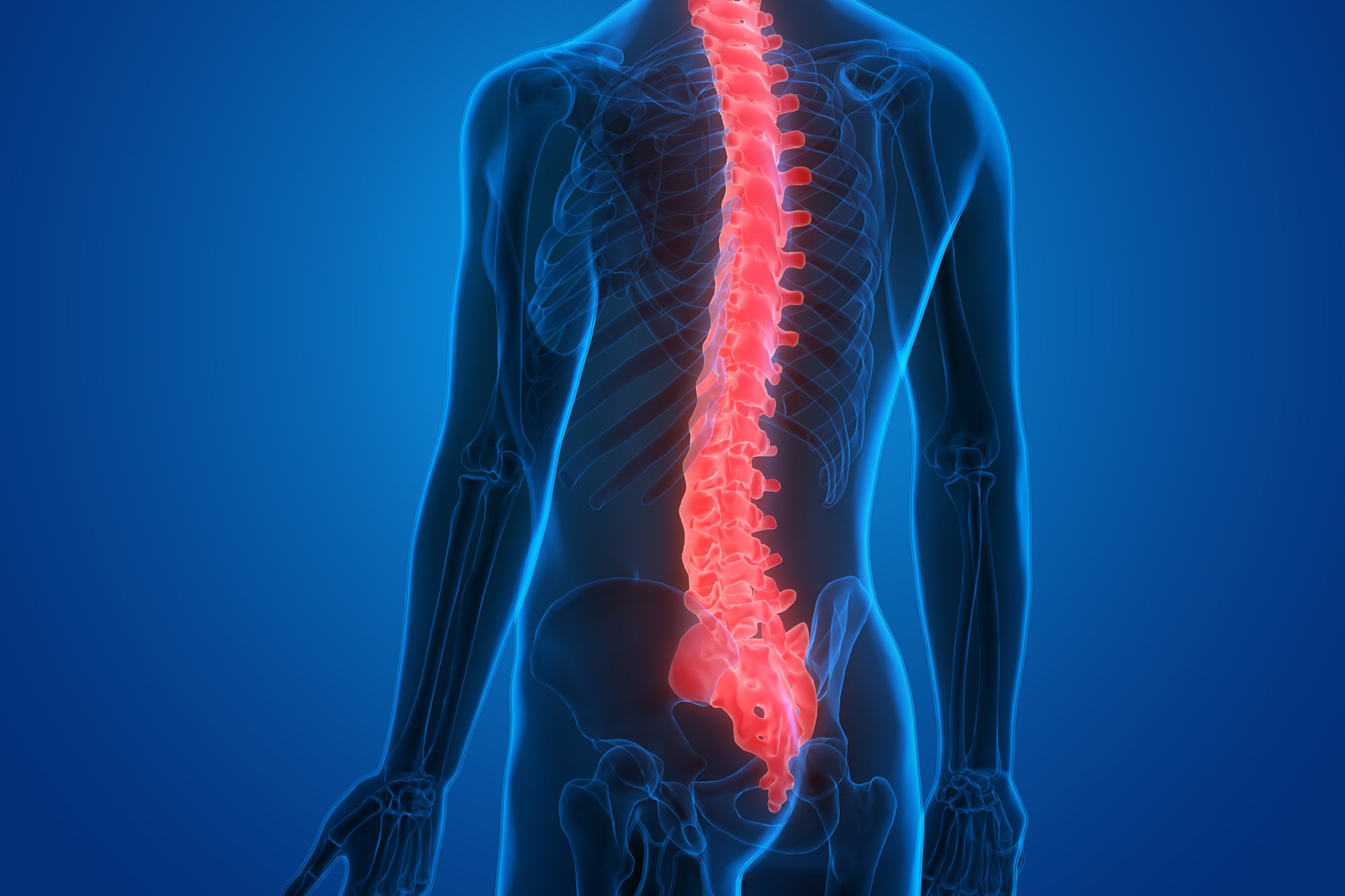

Remarkable Findings – New Research Reveals That the Spinal Cord Can Learn and Memorize

Science

New research demonstrates that the spinal cord can independently learn and remember movements, challenging traditional views of its role and potentially enhancing …

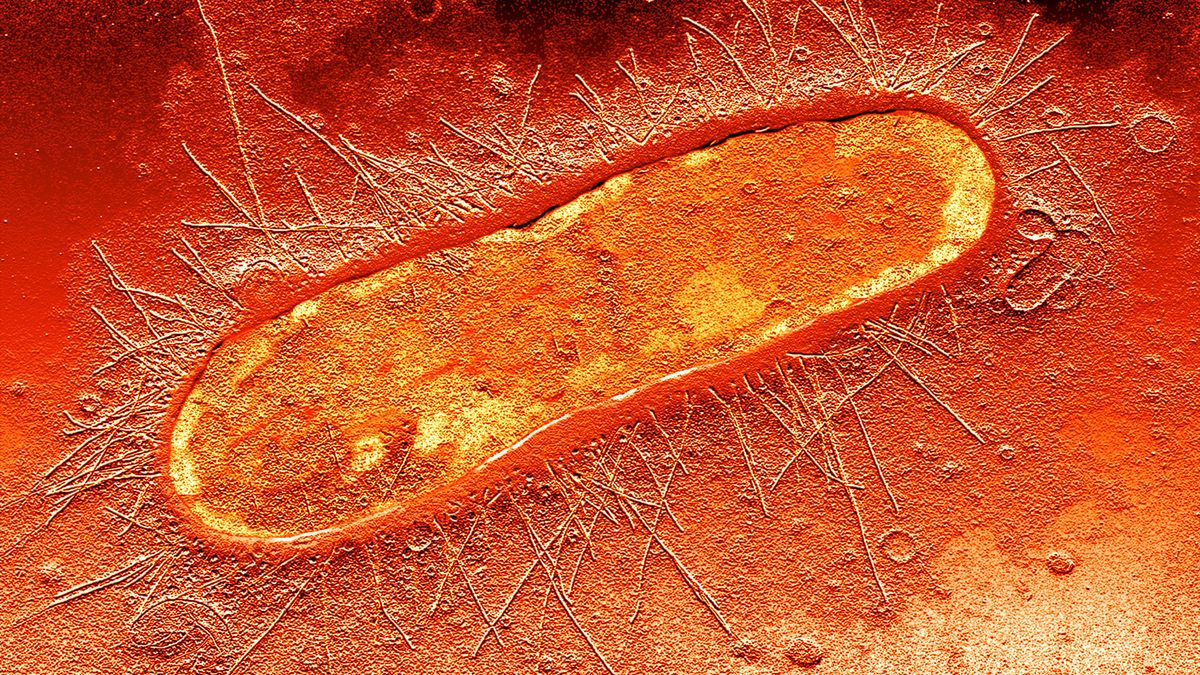

‘Vampire’ bacteria thirst for human blood — and cause deadly infections as they feed

Health

Vampires don’t only haunt the pages of classic novels and spook us in horror movies — they’re also lurking inside the human …

Over 100 arrested at Columbia University as police move in on pro-Palestinian protesters

U.S.

NEW YORK — Police arrested more than 100 people at Columbia University on Thursday at a makeshift encampment set up by pro-Palestinian …

Pulp Fiction Cast Reunites For TCM Classic Film Festival

Entertainment

Photo by Robyn BECK / AFP via Getty Images Pulp Fiction stars John Travolta, Samuel L. Jackson, Uma Thurman and Harvey Keitel …

Vasuki indicus: 50-foot prehistoric snake discovered in India

World

Sign up for CNN’s Wonder Theory science newsletter. Explore the universe with news on fascinating discoveries, scientific advancements and more. CNN — A …

Bitcoin’s next ‘halving’ is right around the corner. Here’s what you need to know

Business

NEW YORK (AP) — Sometime in the next few days or even hours, the “miners” who chisel bitcoins out of complex mathematics …