:max_bytes(150000):strip_icc():focal(999x0:1001x2)/baltimore-bridge-041524-1-d99e3c78d155411996b6ea4be54aebf3.jpg)

U.S.

Fourth Body Found After Baltimore Bridge Collapse

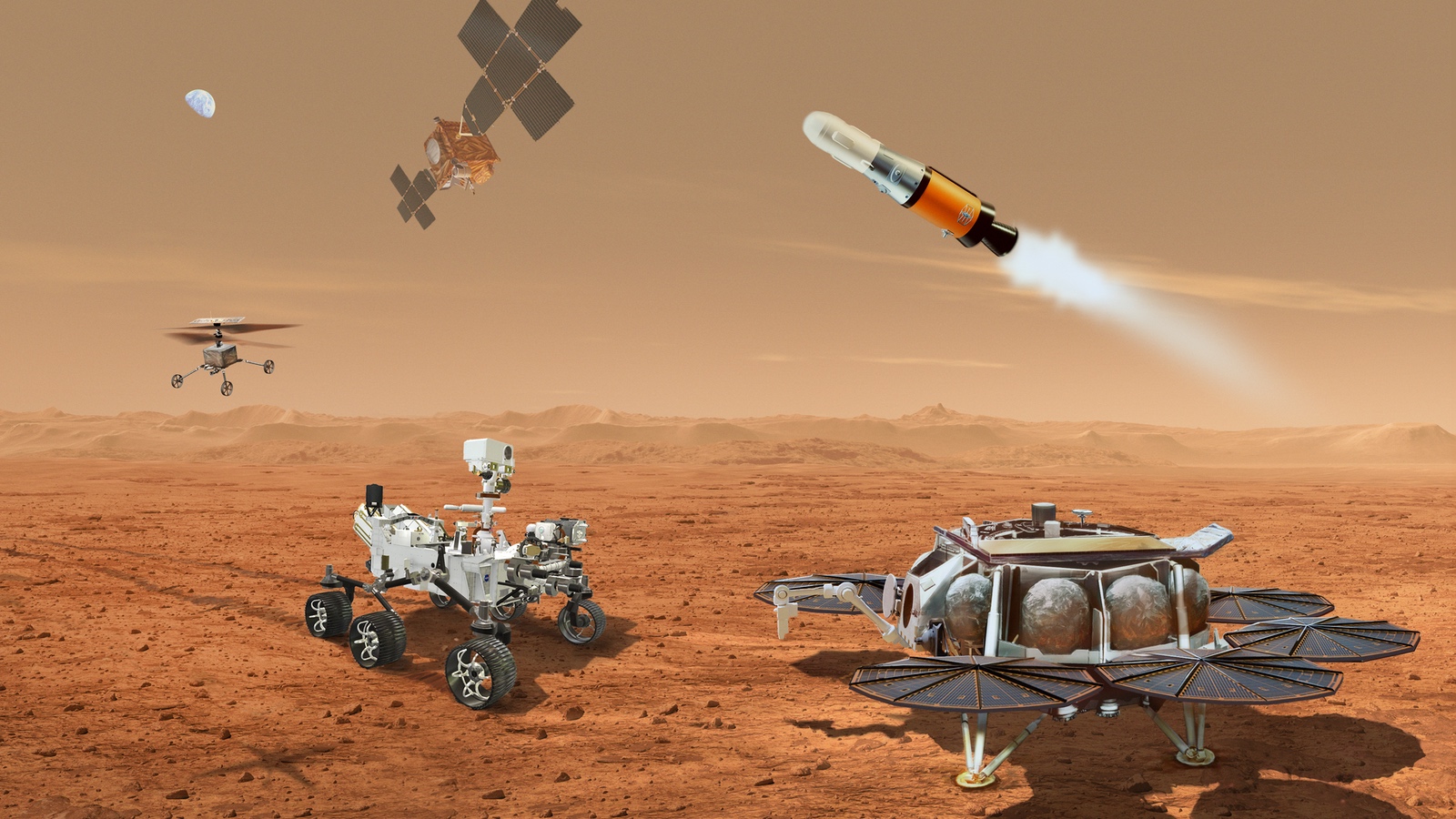

NASA to look for new options to carry out Mars Sample Return program

Science

WASHINGTON — NASA will seek “out of the box” ideas in a bid to reduce the costs and shorten the schedule for …

Here’s why allergy season seems a little more unbearable this year in Philadelphia

Health

PHILADELPHIA (CBS) — About 81 million people have seasonal allergies and the numbers are growing. Doctors say the spring allergy season is …

Ohio man tricked by scam caller shoots and kills Uber driver

U.S.

The Clark County Sheriff’s Office arrested William Brock, 81, in connection with the shooting of Uber driver Loletha Hall in Ohio last …

Kyle Marisa Roth, controversial TikToker, dead at 36

Entertainment

Celebrities By Erin Keller Published April 15, 2024 Updated April 15, 2024, 9:38 p.m. ET Kyle Marisa Roth, a TikToker known for …

Sydney church stabbing is being treated as terrorism, Australian police say

World

SYDNEY (AP) — Australian police say a knife attack in Sydney that wounded a bishop and a priest during a church service …

The busiest airports in the world in 2023, ranked

Business

For the 25th time in 26 years, Hartsfield-Jackson Atlanta International Airport (ATL) was named the world’s busiest airport. The Georgia hub again …

iOS 18: The latest on Apple’s plans for on-device AI

Technology

When WWDC kicks off on June 10, there will be a lot of attention on Apple’s plans for new artificial intelligence features. …

Angel Reese Picked 7th by Sky in 2024 WNBA Draft as Fans Hype Kamilla Cardoso Pairing

Sports

Welcome to Chicago, Angel Reese. The Sky made the former LSU star the No. 7 overall selection at Monday night’s WNBA draft, …