U.S.

Emergency rooms refused to treat pregnant women, leaving Texas woman to miscarry in a lobby restroom – NBC 5 Dallas-Fort Worth

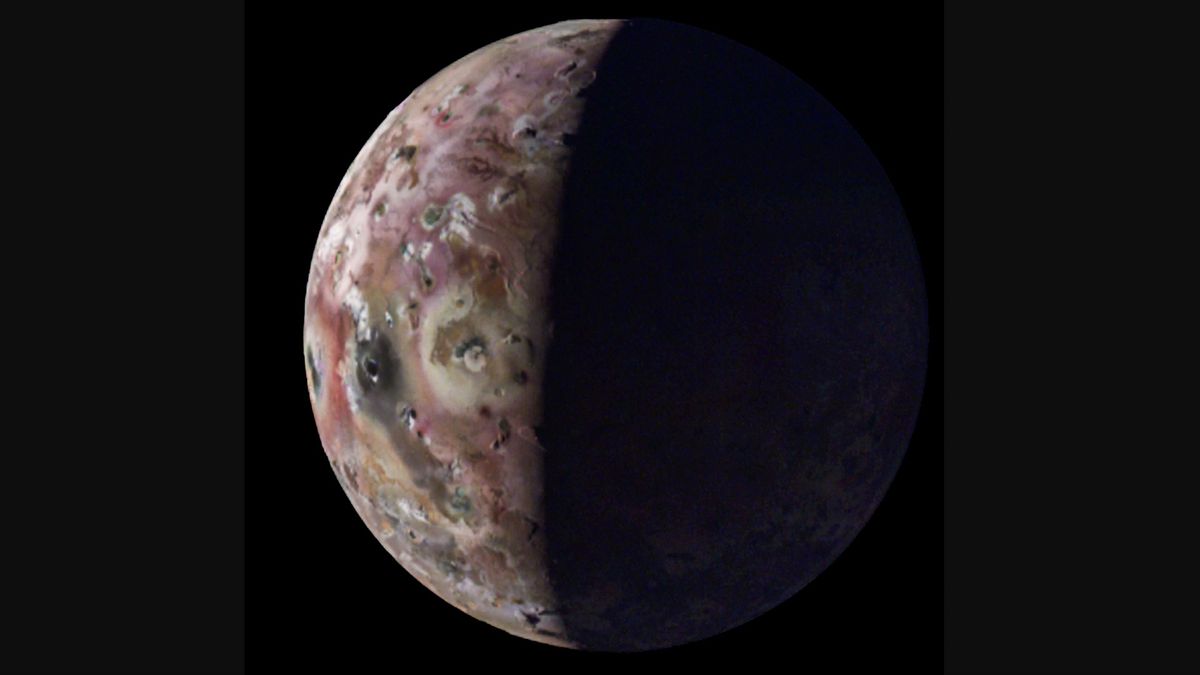

NASA’s Juno probe captures amazing views of Jupiter’s volcanic moon Io (video)

Science

The four biggest moons of Jupiter aren’t just blurry smudges in Galileo’s telescope anymore. The Italian astronomer Galileo Galilei discovered Ganymede, Callisto, …

It’s cutting calories—not intermittent fasting—that drops weight, study suggests

Health

Intermittent fasting, aka time-restricted eating, can help people lose weight—but the reason why may not be complicated hypotheses about changes from fasting …

At Columbia, tensions continue over Israel-Gaza after arrests

U.S.

NEW YORK — Tali Kobrin, a Barnard College student, was deeply uneasy Thursday as she listened to pro-Palestinian protesters at Columbia yelling, …

‘The Tortured Poets Department’ Breaks Spotify Streaming Record

Entertainment

Getty Images for TAS Rights Mana Taylor Swift has made Spotify history with her new release “The Tortured Poets Department,” becoming the …

Huge blast at military base used by Iraqi Popular Mobilization Forces

World

A huge blast rocked a military base used by Iraq’s Popular Mobilization Forces (PMF) to the south of Baghdad late on …

Tesla recalls nearly 4,000 of its 2024 Cybertrucks

Business

Tesla is recalling 3,878 of its 2024 Cybertrucks after it discovered that the accelerator pedal can become stuck, potentially causing the vehicle …

Sony Shuts Down LittleBigPlanet 3 Servers, Nuking Fan Creations

Technology

Sony has indefinitely decommissioned the PlayStation 4 servers for puzzle platformer LittleBigPlanet 3, the company announced in an update to one of …

Chad Reuter 7-round mock draft: Giants take the J.J. McCarthy plunge

Sports

The 2024 NFL Draft promises to be wild, with teams moving all around the draft board to get the players they want. …