World

Dubai sees severe flooding after getting 2 years’ worth of rain in 24 hours

Police Identify 7 Suspects In ‘Potentially’ Anti-LGBTQ Attack On 2 Michigan State Students

U.S.

Police investigating a recent attack on two Michigan State University students have identified seven suspects they believe are connected to the alleged …

Kristen Stewart, Jenna Ortega Movies, More

Entertainment

Jenna Ortega, Kristen Stewart and Lily Gladstone Jon Kopaloff/Getty Images; Emma McIntyre/Getty Images; Amy Sussman/Getty Images The Tribeca Festival has announced the …

US reimposes oil sanctions on Venezuela after broken election promises

World

The US is reimposing sanctions on oil from Venezuela, saying President Nicolás Maduro’s revolutionary socialist government has “fallen short” on commitments to …

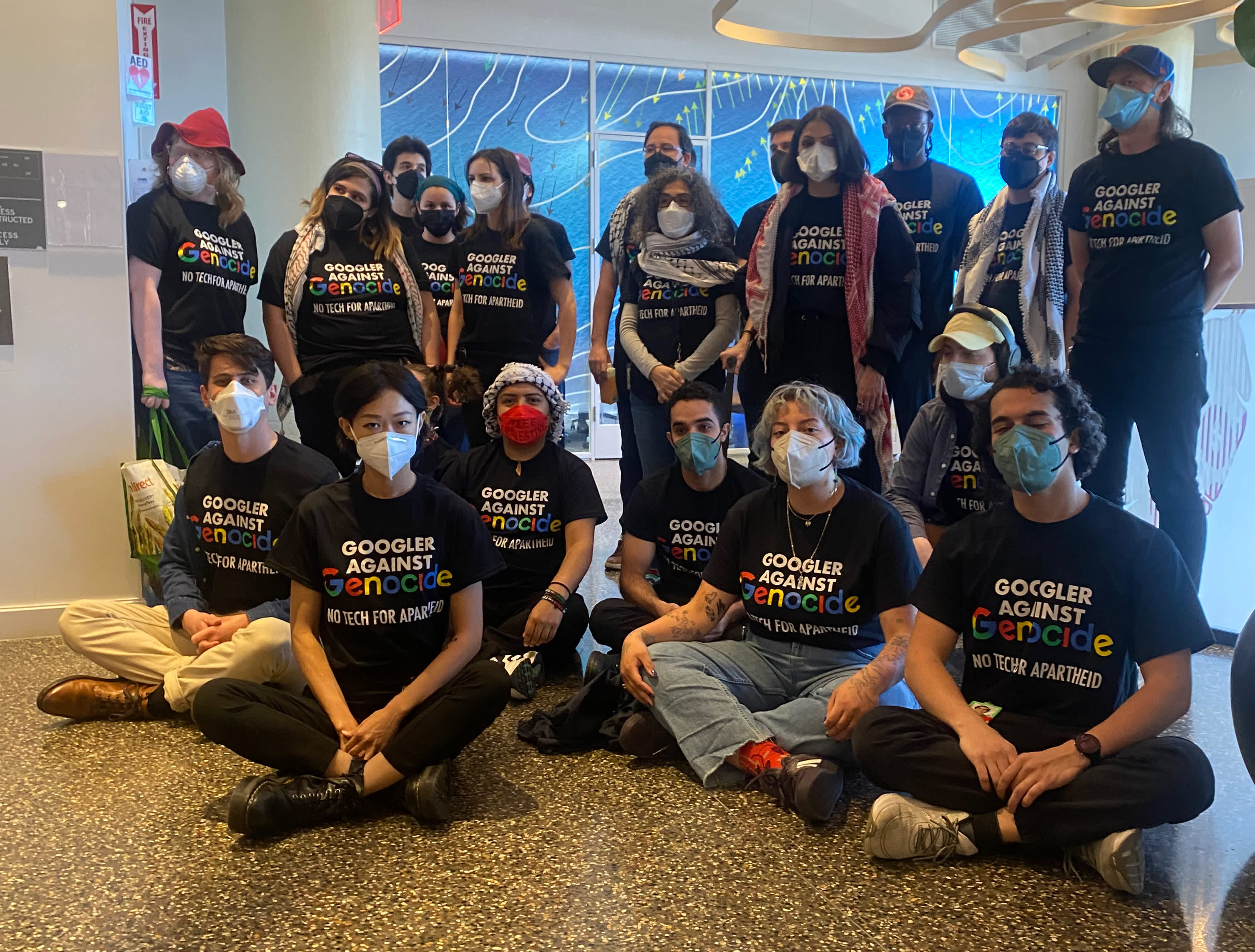

Google workers arrested after nine-hour protest in cloud CEO’s office

Business

Protesters in Sunnyvale sat in Kurian’s office for more than nine hours until their arrests, writing demands on Kurian’s whiteboard and wearing …

Hades 2 play footage reveals all the hot gods

Technology

The technical test for Hades 2 has barely begun, but first-looks at the game have already set feeds on fire. Supergiant Games …

LeBron James, Stephen Curry, Kevin Durant headline USA Basketball Olympic roster

Sports

USA Basketball’s latest “Dream Team” is loaded with star power, experience and a renewed emphasis on size and defense. With this summer’s …

SpaceX launches Falcon 9 rocket on Starlink mission from Kennedy Space Center – Spaceflight Now

Science

A SpaceX Falcon 9 rocket lifts off from the pad at Launch Complex 39A as captured in this streak shot on April …

Autism’s Brain Structure Secrets Revealed

Health

Summary: Researchers developed a groundbreaking approach using Diffusion MRI to explore the brain structures of individuals with autism spectrum disorder (ASD). This …