- BTC holders continue to see profits on their investments.

- This has remained despite the coin’s narrow price movements.

A new report by Glassnode found that Bitcoin [BTC] holders have continued to hold unrealized profits despite the leading coin’s narrow movements in the past few weeks.

At press time, BTC exchanged hands at $65,625. Trending within a horizontal channel, the coin has faced resistance at $71,656 and has found support at $64,825. However, despite this “sideways price movement,” BTC’s “investor profitability remains robust.”

According to the on-chain data provider:

“BTC prices are consolidating within a well-established trade range. Investors remain in a generally favorable position, with over 87% of the circulating supply held in profit, with a cost basis below the spot price.”

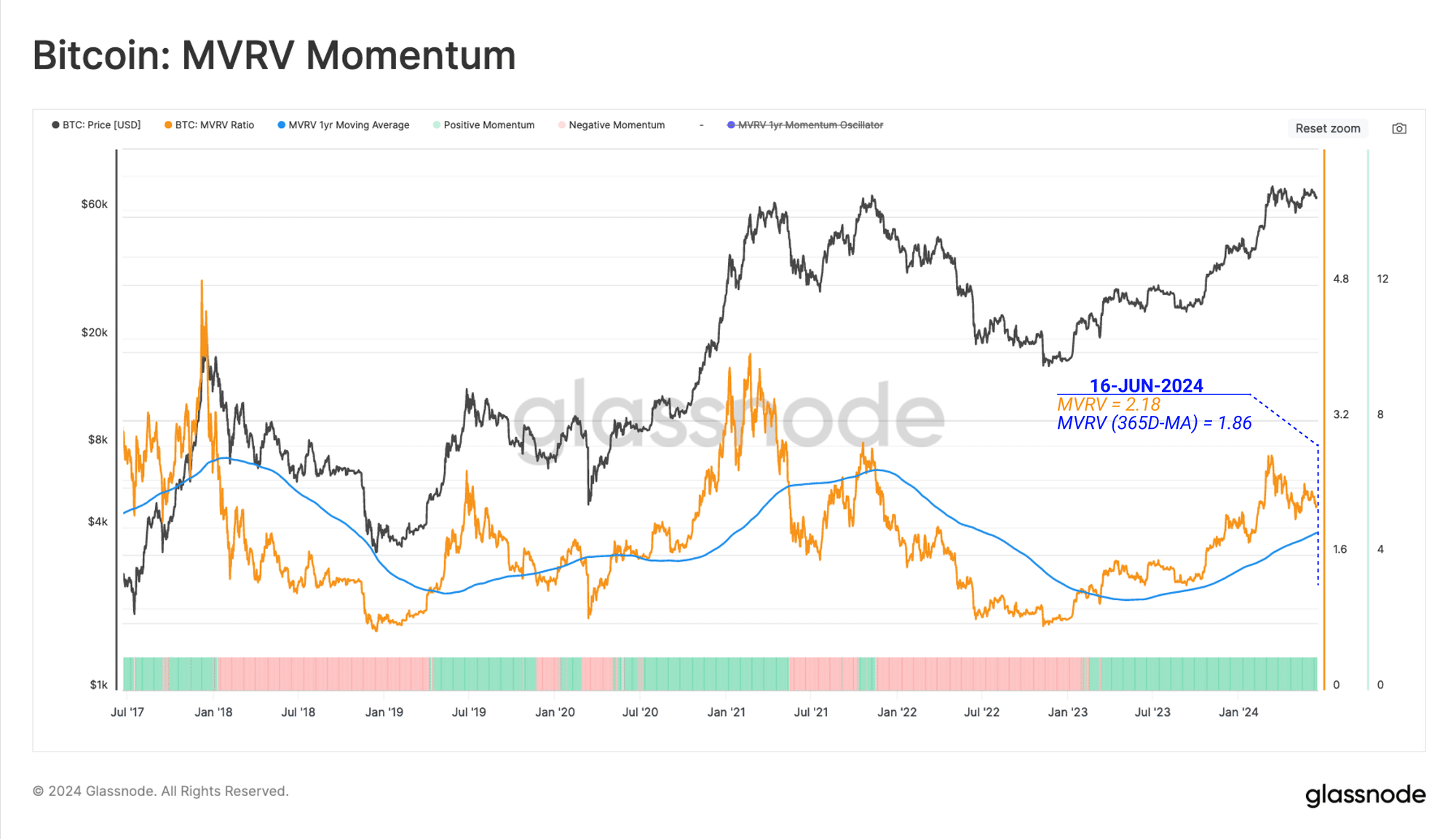

Glassnode assessed the coin’s Market Value to Realized Value (MVRV) ratio and found that the average BTC coin in circulation holds an unrealized profit of over 120%.

Source: Glassnode

Interestingly, despite how profitable BTC holders are, the volume of coins being processed and transferred on the Bitcoin Network since March’s all-time high (ATH) has declined significantly,

Glassnode noted that this decline “underscores a reduced appetite for speculation and heightened indecision in the market.”

Low exchange activity

BTC’s price consolidation has also led to a decline in BTC exchange flows. Glassnode found that BTC’s short-term holders (STHs) currently send approximately 17,400 BTC (valued at $1.13 billion at current market prices) to exchanges daily.

These investors have held their coins for a relatively short period, typically less than 155 days.

Their current exchange inflows represent a 68% decline from 55,000 BTC sent to exchanges by this cohort of investors when the coin climbed to an all-time high of $73,000 in March.

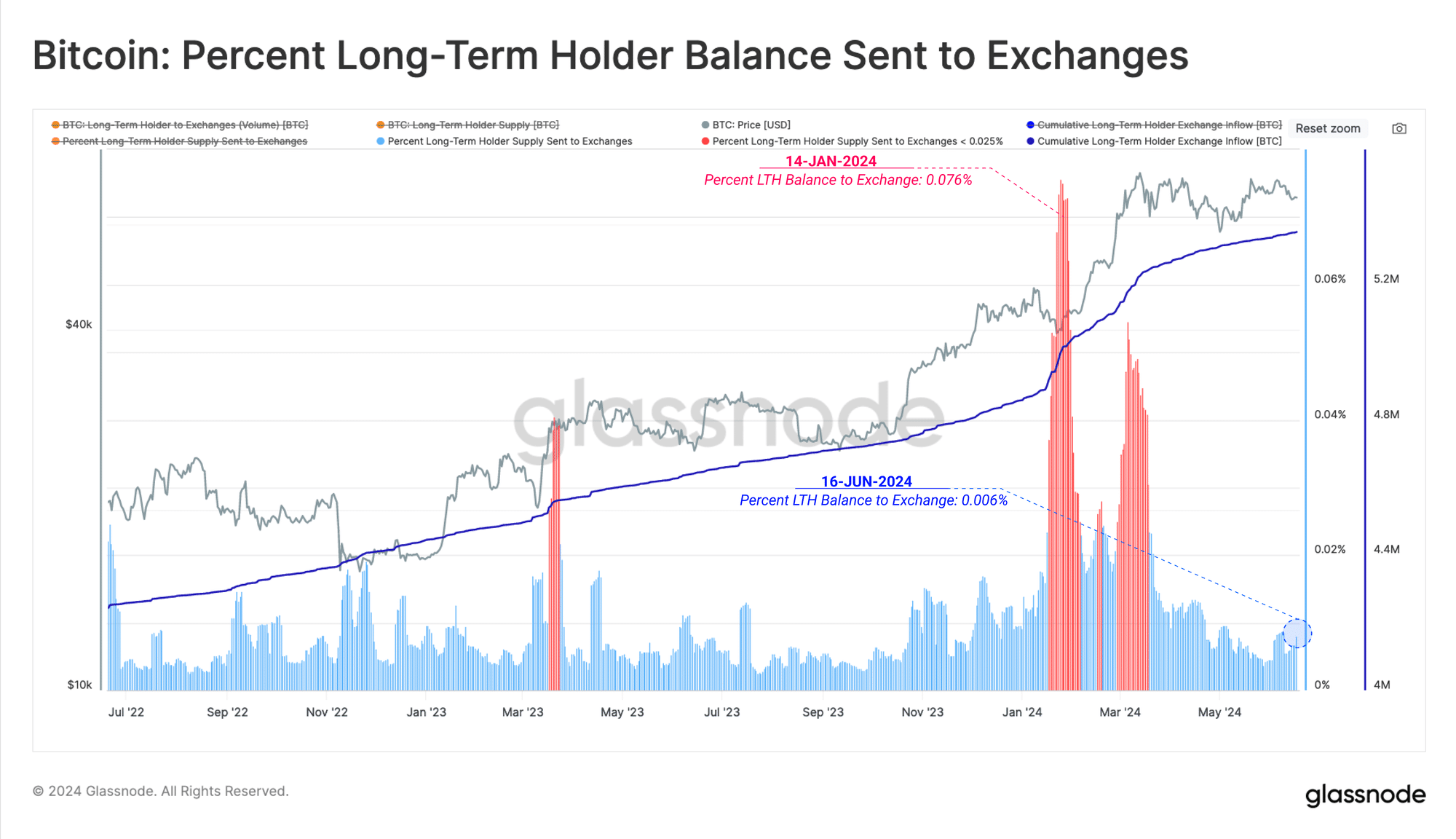

As for long-term holders (LTHs), their “distribution into exchanges is relatively low, with only a marginal 1k+ BTC/day in inflows currently.”

Source: Glassnode

Glassnode said:

“LTHs are sending less than 0.006% of their total holdings into exchanges, suggesting that this cohort has reached equilibrium and that higher or lower prices are required to stimulate further action.”

Read Bitcoin’s [BTC] Price Prediction 2024-25

The average BTC sent to exchanges generates a profit of around $5,500. This has prompted some investors who have held for long to sell for profit.

As the market anticipates a rally to the $73,750 ATH, there is enough demand to absorb the selling pressure. However, it is “not large enough to push market prices higher.”

Barbara Terrio is a seasoned business journalist, delving into the world of finance, startups, and entrepreneurship. With a knack for demystifying complex economic trends, she helps readers navigate the business landscape. Outside of her reporting, Barbara is an advocate for financial literacy and enjoys mentoring aspiring entrepreneurs.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25511693/2151765596.jpg)