- Metaplanet to issue ¥1 billion in bonds to purchase Bitcoin.

- Analysis of Bitcoin’s market fundamentals suggested limited impact on overall price.

Despite a recent downturn in Bitcoin’s [BTC] price, affecting the broader cryptocurrency market, Japanese firm Metaplanet is doubling down on its Bitcoin strategy.

At press time, BTC was trading at $62,825, reflecting a 2.3% decline over the last 24 hours and a 3.2% drop over the past week.

Regardless of these market conditions, Metaplanet has unveiled plans to bolster its Bitcoin holdings significantly.

Details of the investment

Early on the 24th of June, Metaplanet announced a strategic move to issue ¥1 billion ($6.2 million) in bonds at a modest interest rate of 0.5% to purchase Bitcoin.

This signaled a strong commitment to integrating cryptocurrency into its asset management strategy. Part of Metaplanet’s notice read,

“Metaplanet Inc. (3350:JP) hereby announces that the Board of Directors has resolved to purchase Bitcoin worth 1 billion yen as of today’s meeting. The funds for this purchase will be allocated from the capital raised through the issuance of the second series of ordinary bonds (with guarantees), as disclosed separately today in the “Announcement on the Issuance of the Second Series of Ordinary Bonds (with Guarantees).”

Metaplanet further clarified its financial strategy regarding the BTC investments, indicating that that BTC designated for long-term holding will be logged at acquisition cost.

This makes them exempt from market value taxation at fiscal year-end. In contrast, other Bitcoin assets will be regularly assessed at market value each quarter, with any gains or losses impacting non-operating financial results.

Despite a general policy of retaining BTC for extended periods, the company noted that any Bitcoin used for operational purposes would be accounted for as current assets on their balance sheet.

Notably, the decision to acquire more Bitcoin through bond issuance aligns Metaplanet with notable companies like MicroStrategy, which have adopted similar strategies to increase their BTC reserves.

In April, Metaplanet initially added Bitcoin to its balance sheet, following MicroStrategy’s approach to use debt financing for purchasing Bitcoin.

The firm’s shift towards significant cryptocurrency investment marks a transition from its earlier focus on operating budget hotels.

This move is part of a broader strategy to diminish the company’s reliance on the weakening Japanese yen, which has hit its lowest level against the U.S. dollar since 1990.

Impact on Bitcoin?

With Metaplanet’s substantial financial commitment to Bitcoin, the question remains whether a¥1 billion ($6.2 million) Bitcoin purchase will significantly influence the market.

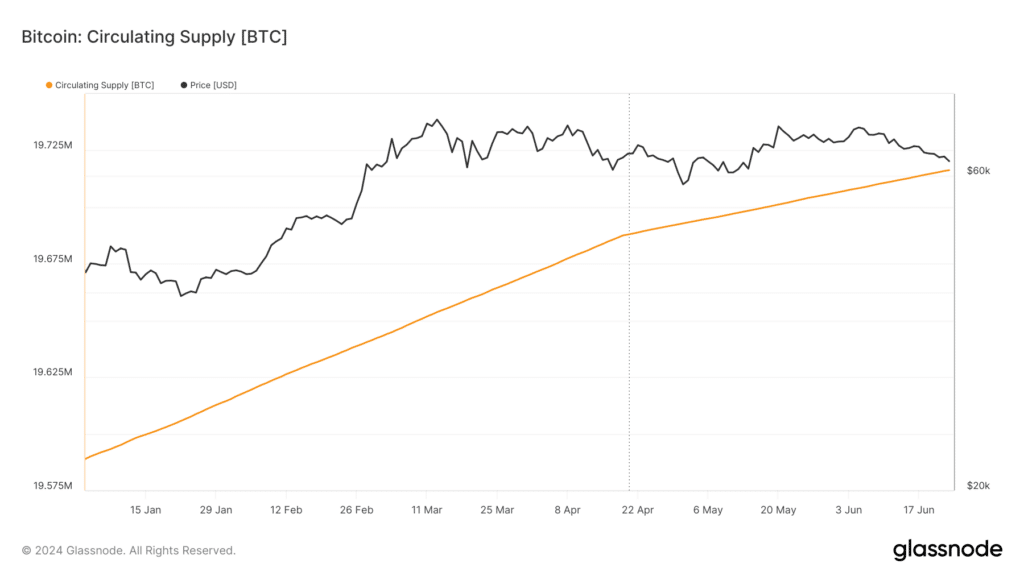

To assess this, it’s essential to consider Bitcoin’s fundamental metrics, particularly the current supply and demand dynamics.

Observing the circulating supply, which has been steadily increasing, reveals that the proposed purchase would constitute only a minor fraction of the market’s total, suggesting it may not dramatically influence Bitcoin’s price.

Source: Glassnode

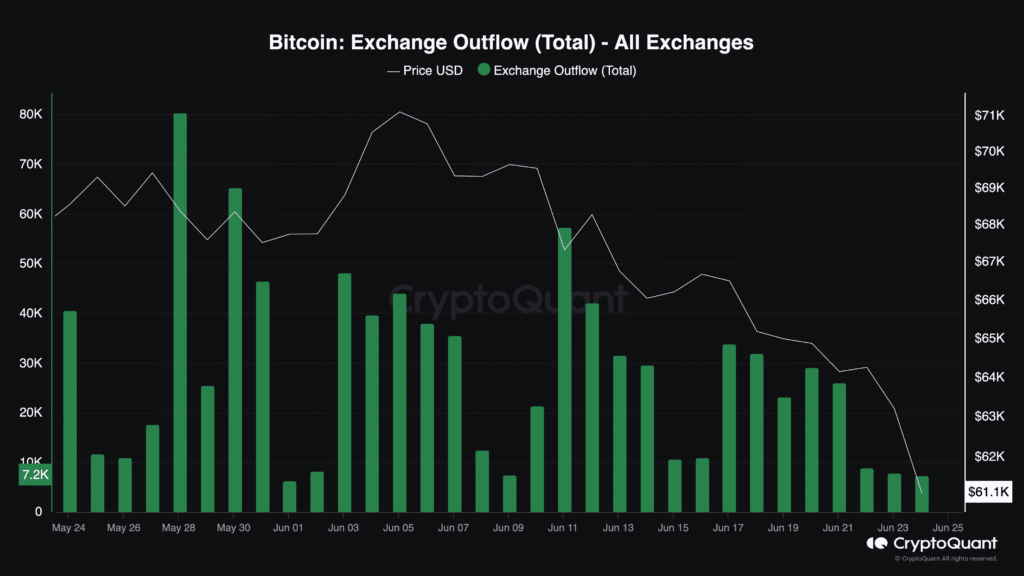

Furthermore, it’s crucial to examine the demand side, specifically the exchange outflow trends. Data from CryptoQuant shows a 1.75% rise in this metric over the last 24 hours.

However, a broader look revealed a month-long decline in outflows, indicating a decrease in buying pressure.

Source: CryptoQuant

On the 23rd of June, about 7,852 BTC left exchanges—a sharp decrease from the 80,000 BTC noted on the 28th of May.

Read Bitcoin’s [BTC] Price Prediction 2024-25

This trend, coupled with recent predictions from AMBCrypto that BTC could drop to $61k, suggested that while Metaplanet’s investment won’t likely cause substantial price movements on its own.

It forms part of a broader market context where demand appears to be waning.

Barbara Terrio is a seasoned business journalist, delving into the world of finance, startups, and entrepreneurship. With a knack for demystifying complex economic trends, she helps readers navigate the business landscape. Outside of her reporting, Barbara is an advocate for financial literacy and enjoys mentoring aspiring entrepreneurs.