Before Nvidia’s (NASDAQ:NVDA) recent April quarter report, the feeling on Wall Street was that the chip giant had to deliver another outstanding print to sustain momentum. While some analysts believed this might be challenging, Nvidia easily surpassed expectations, once again showcasing impressive results that garnered widespread applause from most market watchers.

Among them is Cantor analyst C.J. Muse, , a 5-star analyst rated in the top 2% of the Street’s stock pros, who lauds the AI chip giant for its consistent execution and describes its performance as flawless

“The next industrial revolution has begun with companies and countries partnering with NVDA to accelerate compute in AI factories and deliver Artificial Intelligence,” Muse elaborated. “And aided by a world-class technology platform approach enabled by both hardware and software, coupled with annual cadence of technological improvements (highlighted by CUDA, Sparsity, Precision, NVLink, Grace Coherent Connectivity, and on and on), NVIDIA’s leadership here is simply unquestionable.”

That is quite an endorsement but does not seem out of line with the general reaction to the quarter’s readout.

But Muse thinks that moving forward, the opportunity might be bigger than the one currently considered. In the past, the analyst talked about Nvidia’s revenue potential not as a percentage of cloud spending but rather as linked to global IT spending (around $5 trillion in CY24). Currently, as cloud service providers (CSPs), other consumer internet firms, enterprises, and sovereign entities (expected to become a high-single-digit billion-dollar market in CY25) continue investing in AI infrastructure, it’s becoming apparent that even this projection might be conservative. Over the past decade, Nvidia has lowered the cost of computing by a factor of a million, and if the company can replicate this over the next decade, computing costs will plummet further, thereby “enabling AI to become ubiquitous and NVIDIA’s opportunity to truly continue to be “Open-Ended.”

More in the near-term, the Blackwell GPU architecture is on course for revenues in the second half of CY24 (currently in production at TSMC, with sampling and shipping to follow), while the ongoing high demand for Hopper, which continues to outstrip supply despite shorter lead times, bring a key point to mind. That is, in Muse’s view, there will be “no air pocket in Data Center revenues with clear line of sight for sequential revenue growth through the October/January quarters.”

So, plenty to look forward to, and as such, Muse has now increased his NVDA price target from $1,200 to a Street-high of $1,400, suggesting the stock will gain another 31.5% over the next 12 months. Hardly any need to add, but Muse’s Overweight (i.e., Buy) rating stays as is. (To watch Muse’s track record, click here)

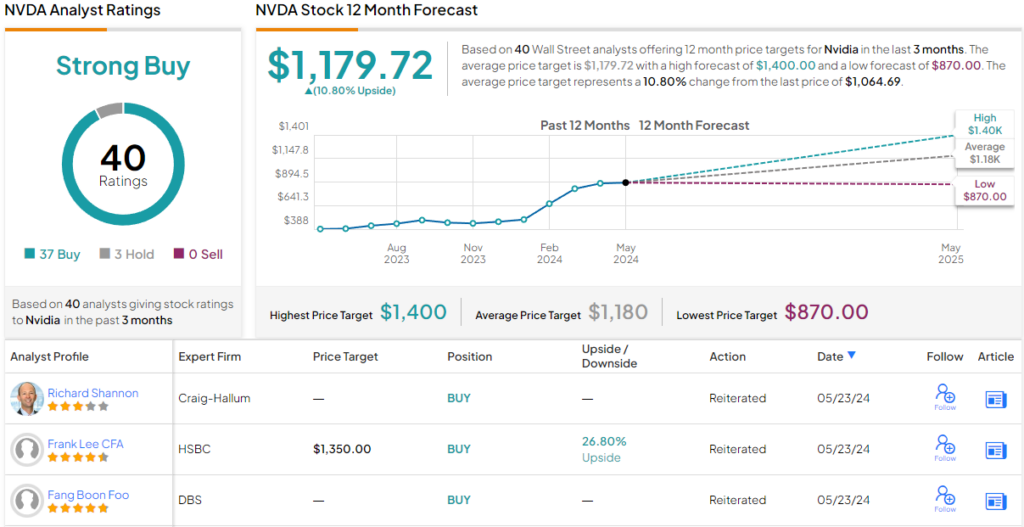

Most analysts agree with Muse here. With 37 Buy recommendations outmaneuvering 3 Holds, NVDA stock claims a Strong Buy consensus rating. At $1,179.72, the average target factors in one-year returns of ~11%. (See Nvidia stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Barbara Terrio is a seasoned business journalist, delving into the world of finance, startups, and entrepreneurship. With a knack for demystifying complex economic trends, she helps readers navigate the business landscape. Outside of her reporting, Barbara is an advocate for financial literacy and enjoys mentoring aspiring entrepreneurs.

/cdn.vox-cdn.com/uploads/chorus_asset/file/25462005/STK155_OPEN_AI_CVirginia_B.jpg)