Policies can have a ripple effect, often going beyond their initial intent. We’re seeing this now from the Federal Reserve, which has made it clear that, in response to stubbornly persistent inflation, it will be holding interest rates higher for longer.

This trend aligns with observations made by David Kostin, Chief US Equity Strategist at Goldman Sachs. Kostin points out that stocks have shown a strong return on equity (ROE) over the past several decades, reflecting a positive combination of profitability and efficiency. However, these prosperous times may be coming to an end as higher interest rates start impacting corporate activities.

“If rates continue to rise or stay higher for longer,” Kostin states in his recent note, “increased borrowing costs would disincentivize companies from taking on greater amounts of leverage.”

To guide investors, Kostin has listed a range of stocks that he believes are “less vulnerable to rising rates and offer stability amid greater macro uncertainty.” Prominent among his picks are credit card issuers and processors. These companies have been benefiting from strong consumer spending in recent years, and the industry giants among them possess the deep resources necessary to weather the impact of rising interest rates. Let’s take a closer look at two of these ‘blue chip’ names.

Mastercard (MA)

We’ll start with Mastercard, one of the market’s true ‘blue chip’ stocks. With a market cap of $374 billion, Mastercard is currently the third-largest of the major credit card issuer/processor companies (Visa and JPMorgan Chase hold the first and second spots, respectively) and has been an industry leader since its founding in 1966.

The company has over 3,900 clients in more than 120 countries and handles more than 125 billion purchase transactions annually at more than 80 million merchant locations.

Mastercard will report its 3Q23 results late this month – but a look at the Q2 results is informative. In Q2, Mastercard showed several solid metrics, starting with the gross dollar volume of $2.3 trillion, up 12% year-over-year. Cross-border transaction volumes were up 24%, and the company’s adjusted net revenue came to $6.3 billion, up 14% from the $5.5 billion in 2Q22, and beating the forecast by $130 million. The company’s bottom line, reported as a non-GAAP adjusted diluted EPS of $2.89, was 6 cents ahead of the expectations.

Among the bulls is Goldman Sachs analyst Will Nance, who sees future growth potential as the key story.

“We continue to see strong tailwinds for MA over the next several years, especially given its greater leverage to the emerging markets, where card penetration is lower, as well as the company’s strategic focus on value added services. With shares currently trading at 27x 2024E P/E, shares are trading roughly in-line with history, and appear cheap relative to the market (even excluding FAAMG). We believe the company’s superior growth profile screens as attractive and would lean into any further weakness over the next few months,” Nance opined.

Looking ahead, Nance rates MA stock a Buy, and his $456 price target implies a one-year upside potential of ~15%. (To watch Nance’s track record, click here)

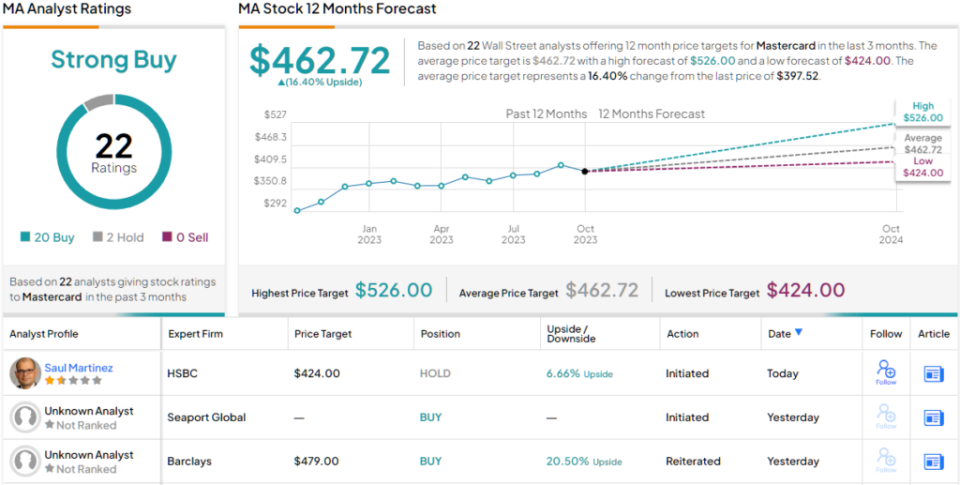

Overall, big-name stocks like Mastercard never lack for Wall Street attention, and there are 20 recent reviews of MA shares with a breakdown of 19 to 1 favoring Buy over Hold for a Strong Buy consensus rating. The stock is currently priced at $397.67 and its average price target of $462.72 is slightly more bullish than the Goldman view, suggesting ~16% gain in the next 12 months. (See Mastercard stock forecast)

Visa Inc. (V)

Next up is Visa, the world’s largest credit card issuer with a market cap approaching $493 billion and more than 4.2 billion branded VISA cards in use, issued by more than 15,000 financial institutions.

Visa handled approximately 269 billion payment transactions in the 12 months that ended this past June 30, conducted through more than 100 million merchant locations in 200 countries globally. There are not many companies that operate on this scale, in any niche.

Visa saw strong performance in the last reported quarter of the company’s fiscal year 2023, which ended in June. The quarter showed a top-line net revenue of $8.1 billion, up 12% year-over-year, and came in $40 million ahead of the estimates. The company’s non-GAAP net income was $4.5 billion, or $2.16 per share; that EPS figure was 4 cents per share better than had been expected.

The company has seen a strong annualized increase in its payments volume of 9%, driven by its ‘cross-border transactions excluding intra-Europe,’ which were up 22%. Total processed transactions were 10% year-over-year.

Checking in again with Will Nance, we find that the Goldman Sachs analyst is sanguine on Visa’s potential going forward. He writes of the company, “Overall, trends in the business continue to be relatively stable and the company sees significant runway remaining for the core consumer payments business, while making progress with new flows (~10x larger opportunity than consumer payments)… We view the space as attractive, with macro sentiment improving and with valuations at relative lows.”

Nance quantifies his bullish stance with a Buy rating on V, while his $286 price target indicates his confidence in a 21% upside on the one-year horizon. (To watch Nance’s track record, click here)

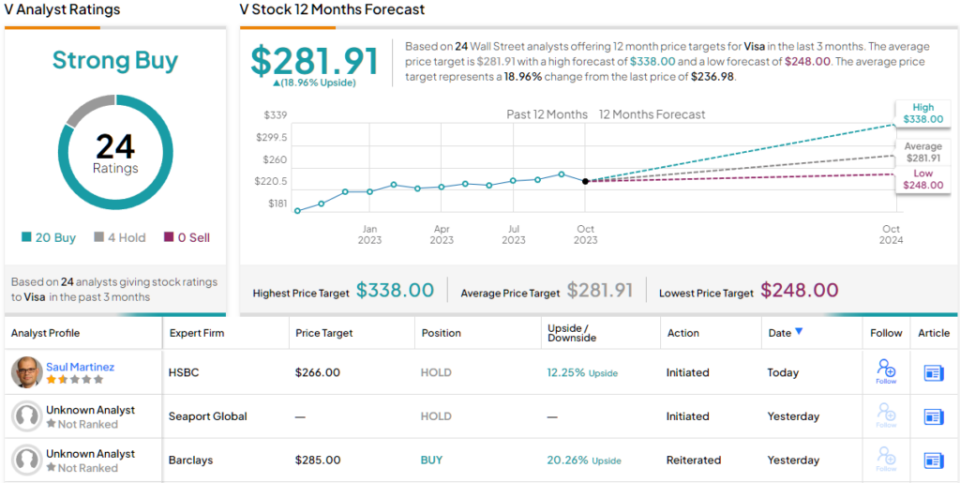

Overall, Visa has picked up 24 reviews recently from the Street’s analysts, and these include 20 Buys and 4 Holds for a Strong Buy consensus rating. The stock’s average target price of $281.91 implies a one-year gain of ~19% from the current share price of $236.96. (See Visa stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Barbara Terrio is a seasoned business journalist, delving into the world of finance, startups, and entrepreneurship. With a knack for demystifying complex economic trends, she helps readers navigate the business landscape. Outside of her reporting, Barbara is an advocate for financial literacy and enjoys mentoring aspiring entrepreneurs.